29+ Tax Calculator Iowa

Simply input salary details benefits and. Web FUTA is an annual tax an employer pays on the first 7000 of each employees wages.

830 Capitol Dr Dane Wi 53529 Realtor Com

Over 90 million taxes filed with TaxAct.

. Web Iowa Salary Tax Calculator for the Tax Year 202324. Web Estimate my Federal and State Taxes. Web The total taxes deducted for a single filer in Appanoose county are 92649 monthly or 42761 bi-weekly.

Just enter the wages tax withholdings and other information. Iowa will no longer have its own standard or itemized deductions incorporating the federal standard or itemized deduction instead. You can find instructions about income subject to IA withholding.

Start free and prepare a current tax year federal and state income tax return for exact results. After tax the total take home pay is 4609254. Free tool to calculate your hourly and.

Summarized below is a partial list of individual income tax law changes which are effective beginning in tax year 2023. Web Using a Payroll Tax Service. Web Here are Iowas state income tax rates for the 2022 tax year for single filers.

But how do I know how much I owe. -44 on the first 6000 taxable income -482 when the income is between 6001 and 30000. Ad Filing your taxes just became easier.

Web View tax tables for all filing statuses. Web Curious to know how much taxes and other deductions will reduce your paycheck. Web Individuals earning less than 1743 per year will face a flat tax rate in 2022.

Alternate Tax Calculation You may owe less tax by completing the worksheet below to compute your tax liability. Using our free Iowa tax. Use our paycheck tax calculator.

There are nine different income tax brackets in the Iowa tax system. The FUTA rate for 2023 is 60 but many employers are able to pay less for instance up to. The rate ranges from 033 on the low end to 853 on the high end.

Web The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your. Web The Iowa Tax Calculator. Web If a single filer in Iowa earns 59000 the total income tax will be 1290746.

Who needs to file and pay estimates. Web The Iowa income tax has nine tax brackets with a maximum marginal income tax of 853 as of 2023. Web For tax year 2024 each of the seven rates will apply to the following new income tax brackets.

Updated on Sep 19 2023. For individuals who make more than that the Iowa income tax rate will be 68. Start basic federal filing for free.

The Iowa salary paycheck calculator will calculate the. Web Select your pay period from the following options. Web If you owe more than 200 in income taxes you must pay an estimated tax when you file your Iowa state taxes.

This is only a high level federal tax income estimate. The Department is in the. Web Report Fraud Identity Theft.

Updated on Jul 18 2023. You can use our free Iowa income tax calculator to get a good estimate. Every individual or married couple.

Enter your gross taxable wages for this pay period. All taxpayers must now. Income up to 11600 23200 for married couples filing.

Pay electronically using eFile Pay. Web Iowa charges a progressive income tax broken down into nine tax brackets. Start free and prepare a current tax year federal and state income tax return.

This is only a high level federal tax income estimate. Web Iowa residents are subject to personal income tax. All filing statuses except.

Use Iowa Paycheck Calculator to estimate net or take home pay for salaried employees. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202324. Web Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

File your taxes stress-free online with TaxAct. Web Iowa Individual Estimated Income Tax Instructions taxiowagov.

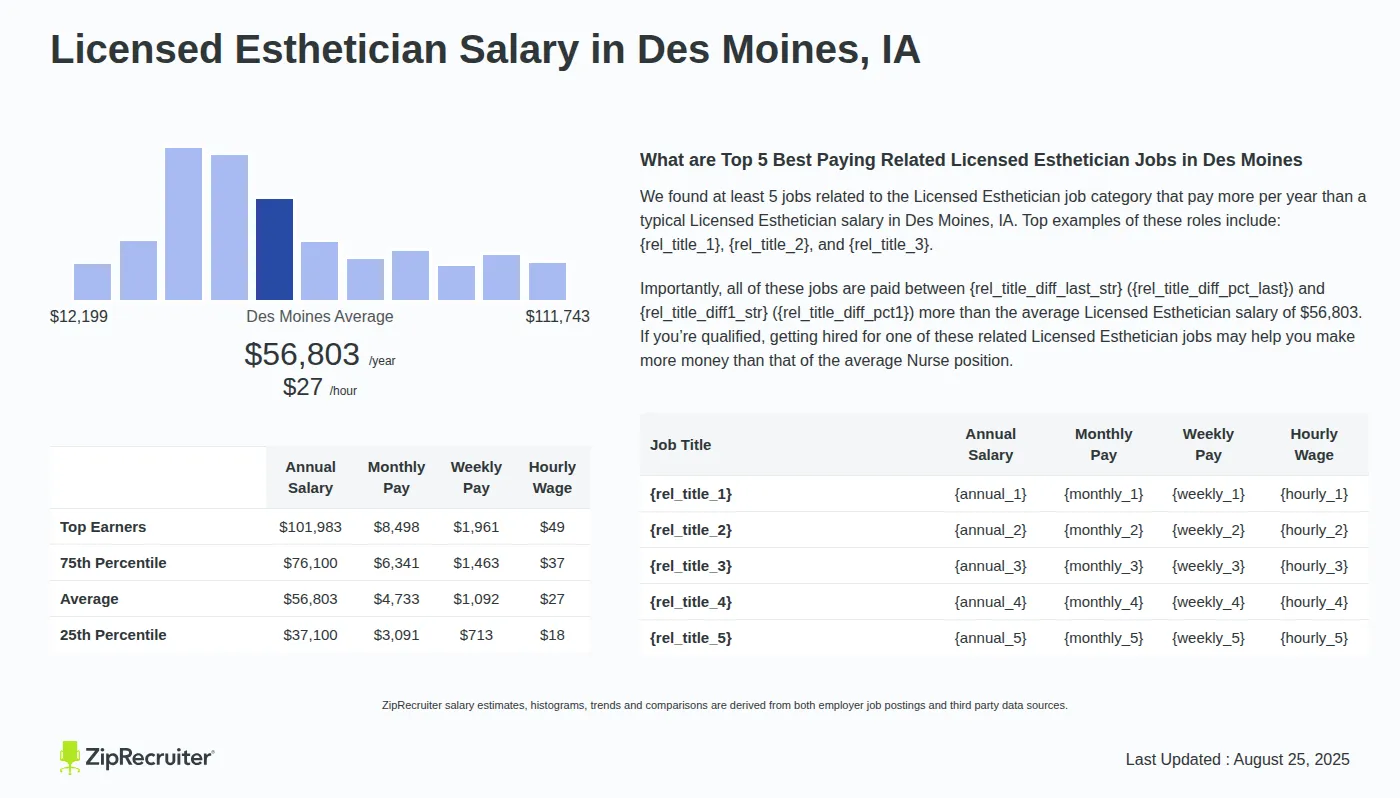

Licensed Esthetician Salary In Des Moines Ia Hourly

4 Landscaping Invoice Templates Pdf Word

Iowa Sales Tax Calculator

Au Pair And Host Family Taxes My Au Pair And Me

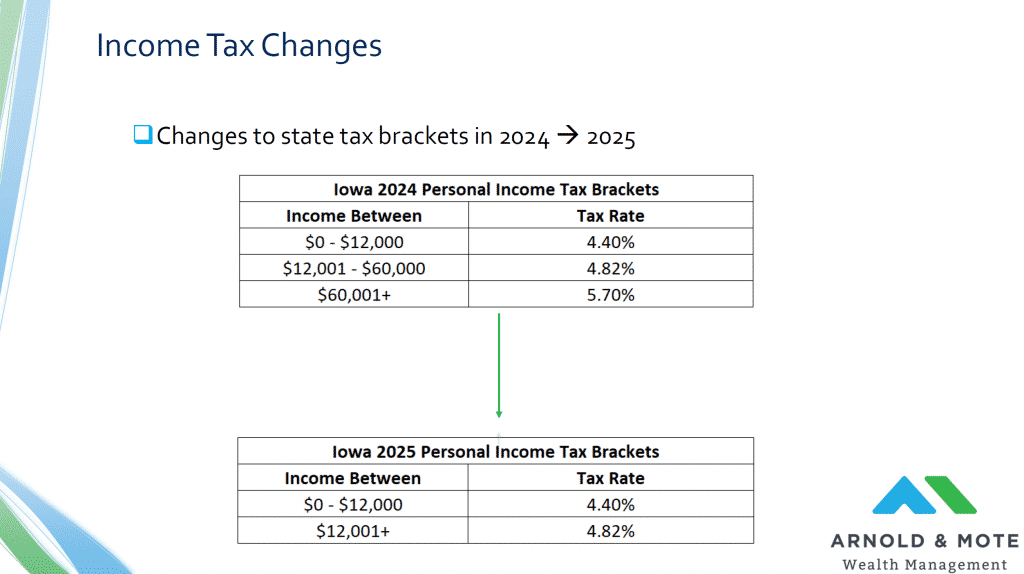

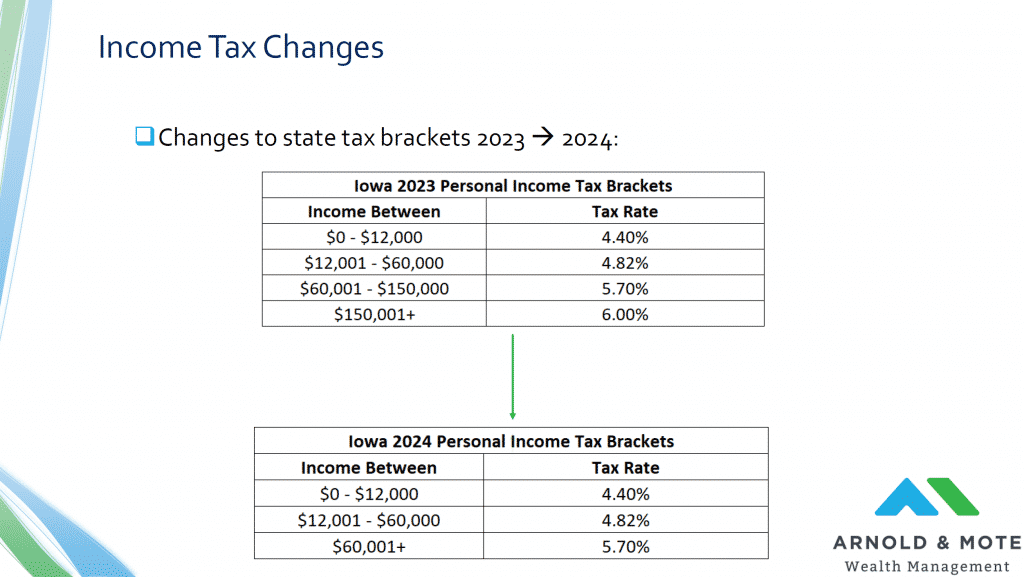

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Fillmore County Journal 10 21 19 By Jason Sethre Issuu

Pdf The Iowa Department Of Public Health Gambling Treatment Services Four Years Of Evidence Howard J Shaffer Academia Edu

Pdf Environmental And Climate Analysis For The Norwegian Agriculture And Food Sector And Assessment Of Actions Karen Refsgaard Academia Edu

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

29 States Are Bringing In Sales Tax Economic Nexus Are You Ready Webretailer Com

Pdf Environmental And Climate Analysis For The Norwegian Agriculture And Food Sector And Assessment Of Actions

Pdf Environmental And Climate Analysis For The Norwegian Agriculture And Food Sector And Assessment Of Actions Karen Refsgaard Academia Edu

Pdf The Iowa Department Of Public Health Gambling Treatment Services Four Years Of Evidence

82 North St Marquette Ia 53158 Mls 1940057

Iowa 2023 Sales Tax Calculator Rate Lookup Tool Avalara

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Pdf Environmental And Climate Analysis For The Norwegian Agriculture And Food Sector And Assessment Of Actions